A fee sometimes paid on top of a management fee if an investment company outperforms its benchmark or meets other conditions.

Here you’ll find definitions of terms used on the AIC site. Enter the term you want to search for in the box, or click on the letter it begins with.

A collection of different investments selected by fund managers to deliver returns to investors and to spread risk.

Most investment companies have a portfolio of tens, or even hundreds, of different investments in order to spread risk. This is called diversification and is one of the key benefits of investing in a collective investment fund like an investment company.

The expected income from the portfolio over the next 12 months as a percentage of the total assets.

Portfolio yield is only a measure of how much income the portfolio is expected to produce. It doesn’t take into account any expenses, interest and tax that might be incurred. Though a higher portfolio yield might indicate that the company will pay a higher level of dividends, you shouldn’t assume that this will be case. The actual income received might also differ from the expected income.

See also dividend yield.

Buying shares on a regular basis to smooth out the ups and downs in the share price.

Pound-cost averaging can be a useful technique if you’re worried the stock market might fall in the near future. You invest over time instead of all in one go, so you end up buying more shares when the price is low and fewer when the price is high. Over time, this can help to smooth out some of the ups and downs in the share price.

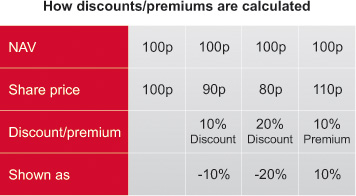

The amount, expressed as a percentage, by which the share price is more than the net asset value per share.

Learn more about discounts and premiums

See share price.

Investing in shares of private companies, as opposed to companies whose shares are traded on stock markets.