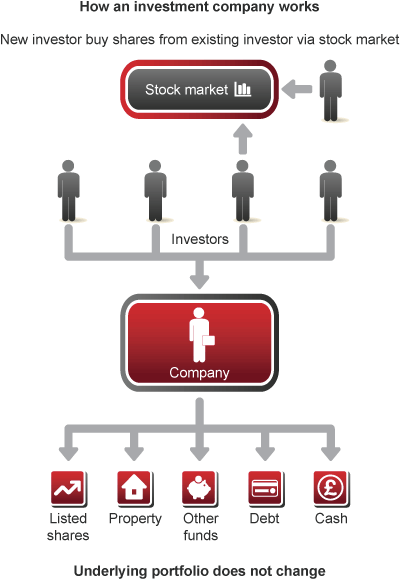

A closed-ended investment company has a fixed number of shares in issue at any one time. These are traded backwards and forwards on the stock market, which has no impact on the underlying portfolio.

As well as allowing managers to take a longer-term view, this enables investment companies to invest in specialist illiquid asset classes such as private equity, venture capital and property.

See also open-ended fund