GCP Asset Backed Income updates on strategic review

GCP Asset Backed Income has published more information on its portfolio and its strategic review. In addition, an updated portfolio report is now on the company’s website at https://www.graviscapital.com/funds/gabi-strategic-review/literature.

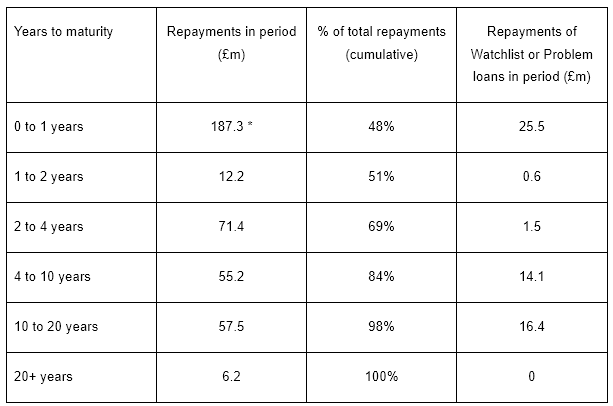

Portfolio repayment profile

As at 31 December 2023, the company was invested in a portfolio of 42 asset backed loans with a weighted average loan duration of 4.3 years. At that date, the principal value of the portfolio and the net asset value were £374.6m and £396.7m, respectively.

The current contracted cash repayment profile of the Portfolio, including the repayment of historic and future forecast capitalised interest, and after provisions for certain Problem or Watchlist Loans as advised by the Investment Manager, is shown below.

* Includes the assumed receipt of £32.5m of repayments that were due on or prior to 31 December 2023, of which £0.8m has now been received by the company and the remainder of which includes three problem or watchlist loans.

- Loans made to seven borrowers and representing 11.4% by value of the NAV (£45.1m) have been categorised by the manager as problem or watchlist loans, based on meeting at least one of the following tests: (i) a likelihood that future interest and principal payments will not be serviced; (ii) debt service is outstanding for more than 6 months; and/or (iii) a persistent covenant breach.

- Approximately 88% of the company’s loans by value are exposed to property, including loans exposed to property in social infrastructure sectors such as student accommodation, social housing and care homes. The portfolio includes exposure to seven projects that are under construction, representing about 18% of the portfolio value.

- The portfolio includes subordinated loans which are subordinate to the borrowers’ senior debt. Such loans represent 32% of the portfolio value.

By way of illustration, and assuming all loans repay in accordance with their contractual terms, and that loans scheduled for repayment in 2023 are repaid by no later than 31 December 2024, in the event of an orderly wind down, about 69% of its principal outstanding is scheduled to be repaid by the end of the financial year ended 31 December 2027.

Shareholder consultation

As part of the review, the board is seeking shareholder feedback. Barclays, as financial adviser and corporate broker to GABI, will contact key shareholders to arrange meetings with the board shortly.

The board wants to hear about views on:

- a potential continuation of the company in accordance with its current investment policy with the same manager, but paired with a partial return of capital;

- a suitable time horizon for the return of capital in a potential orderly wind down; and

- acceptable pricing on a potential sale of the company.

Share buyback programme

The revolving credit facility (RCF) has been fully repaid. The board is talking to advisers about initiating a £7m share buyback programme.

Expected timetable of events

The anticipated dates and sequence of events relating to the Strategic Review are set out below:

|

Initial shareholder consultation period |

29 January to 23 February 2024 |

|

Publication of outcome of the Strategic Review |

mid-March 2024 |

|

Posting of AGM notice / shareholder circular |

mid-April 2024 |

|

AGM of the Company |

15 May 2024 |

GABI : GCP Asset Backed Income updates on strategic review