The continued growth of green and sustainable finance

By Buchanan Communications.

Representatives from Buchanan Communications were delighted to attend the 10th Anniversary Guernsey Funds Forum in London. As usual, the panel discussions involved fascinating in-depth assessments of major investment trends not only in the Guernsey investment funds community but also issues of global investor concern.

Representatives from Buchanan Communications were delighted to attend the 10th Anniversary Guernsey Funds Forum in London. As usual, the panel discussions involved fascinating in-depth assessments of major investment trends not only in the Guernsey investment funds community but also issues of global investor concern.

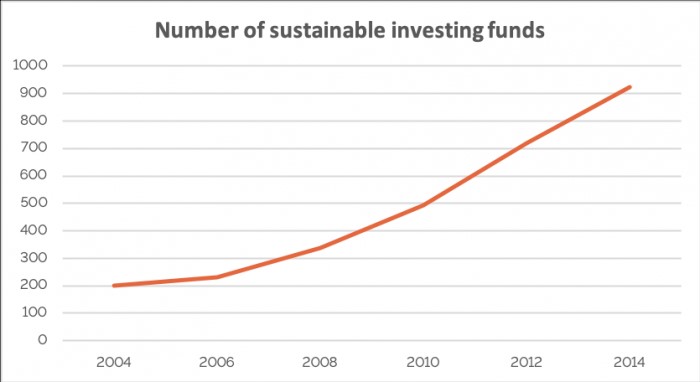

One of the most striking topics was an assessment of the steady progress of Green & Sustainable Finance — or, more holistically known as Environment, Social and Governance (ESG) investing — as it moves into an increasingly dominant role in mainstream investment allocations.

This discussion underlined a number of key developments that we haves been observing for some time from working with our clients on public relations matters as well as reading what major commentators have to say on the topic. EY for one, claims that sustainable investment strategies have grown by 107.4% annually since 2012 and currently account for 18% of US wealth management industry’s total AUM.

Strong commitments from bulge bracket banks

There was certainly a feeling that renewable energy investing has truly ‘come of age’ in a market that, although not always seen as mature, is certainly maturing. Some renewable energy sectors that were seen as ‘frontier’ five years ago are now attracting capital at great scale. Major institutional players are committing considerable sums of capital to the sector, for instance, Goldman Sachs alone has committed $150 billion to clean energy projects and technology.

New investment technologies and geographies for investors to choose from

Against this backdrop we have seen a variety of new London-listed investment companies in the renewable and clean energy sector come to market. These included new asset classes such as Gore Street Energy Storage Fund* and SDCL Energy Efficiency in 2018, the first London-listed energy storage and energy efficiency funds, respectively.

Access to new geographies through the established technologies is also being sought after by London-listed investment-company investors. For example, the capital raising success of US Solar Fund PLC in 2019, the first pure-US solar play to list in London, was a testament to this development.

In the meantime, existing and proven investment companies in renewable investment have seen their share prices reach new highs, notably Bluefield Solar Income Fund* that recently obtained Guernsey Green Fund status.

Renewable energy is just the tip of the iceberg

But ESG investment is not all about renewable energy. As interest in ESG investing grows, investment and operating companies of all sectors need to consider whether they are fully addressing this important area of investor concern.

One key factor here is the increasing importance of the millennial investor. EY claims that millennials will ultimately receive US$30 trillion of wealth through inheritance. These millennial investors are more than twice as likely to allocate their capital to investment strategies that target social causes and/or environmental outcomes than preceding demographics. How they choose to deploy their capital could be a major influencing factor in future investment trends.

Return on investment & ESG – no longer at loggerheads

Ultimately much of the available capital will still follow the opportunities that offer the best returns on investment. Previously, investors were of the mind that gaining exposure to ‘impact investing’ trends meant lower returns.

However, from the panel discussions at the Guernsey Funds Forum, it was anticipated that investments prioritising ESG considerations, should ultimately outperform their rivals who fail to prioritise ESG as investor and consumer habits evolve. Clearly, this could have a major effect on capital flows into the ESG sector.

Further, as warnings about climate change and, increasingly, biodiversity loss from all sides intensify, there is seen to be a need to invest in green and sustainable investments to address the major financial risks posed by the dramatic changes in the global working economic systems that these two issues could potentially trigger.

It is clear to Buchanan that concern around the deployment of capital into green and sustainable strategies is becoming an increasingly important issue for investors of all sizes. Issues such as climate change, biodiversity loss and the appropriate use of water resources are becoming increasingly mainstream on a global scale in the constantly evolving investment landscape.

*Denotes a Buchanan current client