AIC launches investment company screener for advisers

New tool allows users to filter and compare investment companies more easily.

The Association of Investment Companies (AIC) has launched a new free research tool for financial advisers and other professional investors, Investment Company Screener.

The Association of Investment Companies (AIC) has launched a new free research tool for financial advisers and other professional investors, Investment Company Screener.

The research tool sits alongside others on the AIC website (www.theaic.co.uk) that are available to all investors, including Find and compare investment companies and Interactive Statistics. However, it differs in that it has been developed specifically for a financial adviser audience, following feedback from IFAs.

Nick Britton, Head of Intermediary Communications at the Association of Investment Companies (AIC), said: “Our aim is to continually improve the data and information we provide for financial advisers. Investment Company Screener allows advisers to filter and compare investment companies in quite a few ways that haven’t been possible before. For example, you can now filter investment companies by their gearing level, ongoing charge or even the tenure of their fund manager.

“It’s also possible to identify investment companies with a certain equity style – so if I want to find an investment company that invests in global emerging markets with a mid-cap value tilt, I can do so in seconds.

“This tool has been developed following extensive adviser feedback and we hope it will make it easier for advisers to explore what investment companies have to offer.”

How does it work?

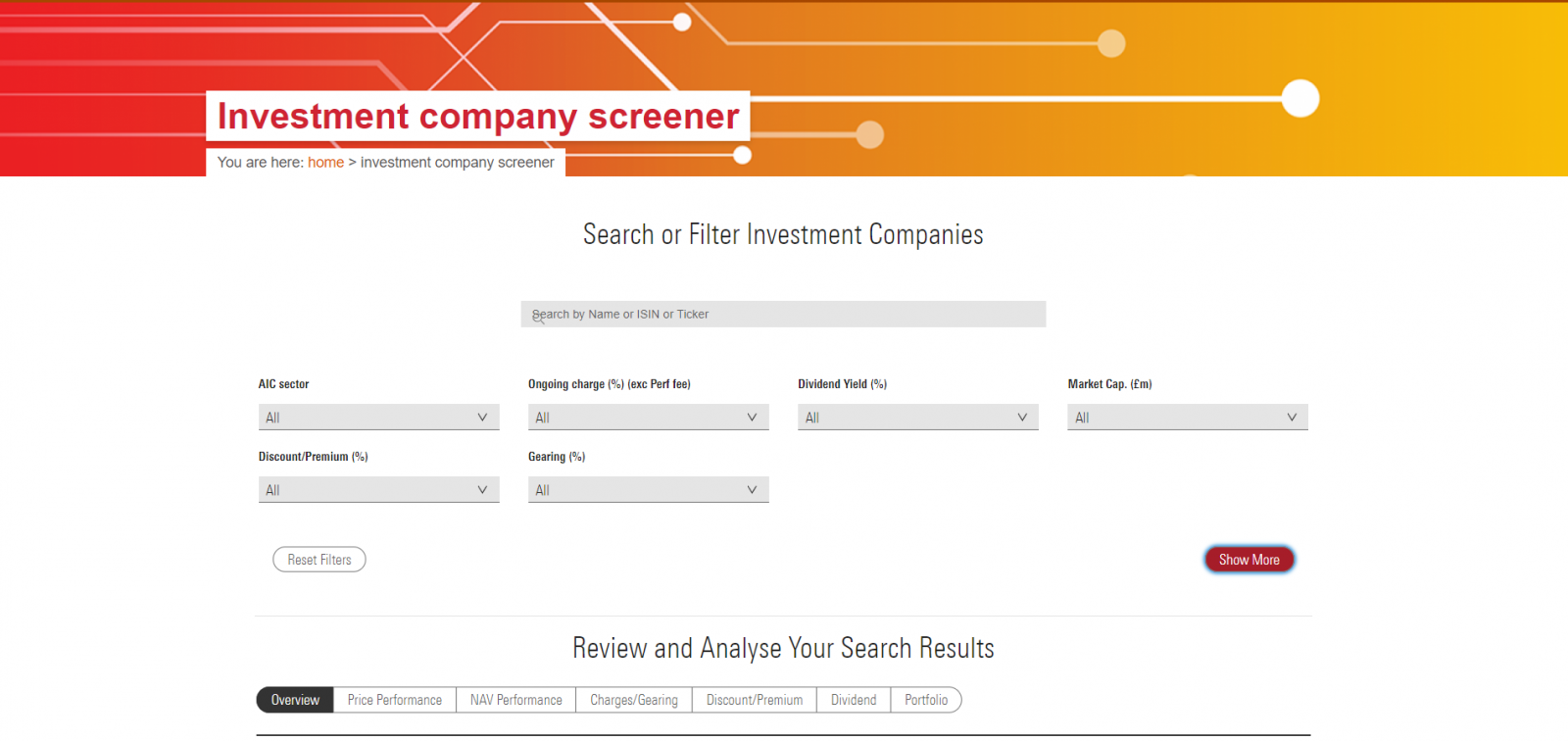

Investment Company Screener allows users to identify relevant investment companies in three easy steps:

- Search or Filter Investment Companies. Users can filter investment companies by 18 different criteria, including AIC sector, ongoing charge, dividend yield, market cap, discount/premium, gearing, manager tenure, dividend frequency, dividend cover, annualised total returns and equity style. For many of these criteria, such as manager tenure, annualised total returns and equity style, it is the first time the data has been made available in this searchable format.

- Review and Analyse Your Search Results. Depending on the filters they have selected, users will be presented with a list of investment companies that match their criteria. They can then select up to five of these companies to make a detailed comparison.

- Compare in Depth. The final stage of the process allows users to compare their chosen investment companies across more than 50 different data points including performance and portfolio characteristics.

Investment Company Screener was developed for the AIC by fund data provider Morningstar. It is free to access for those who have registered as financial advisers on the AIC’s website.

Daily PDF factsheets

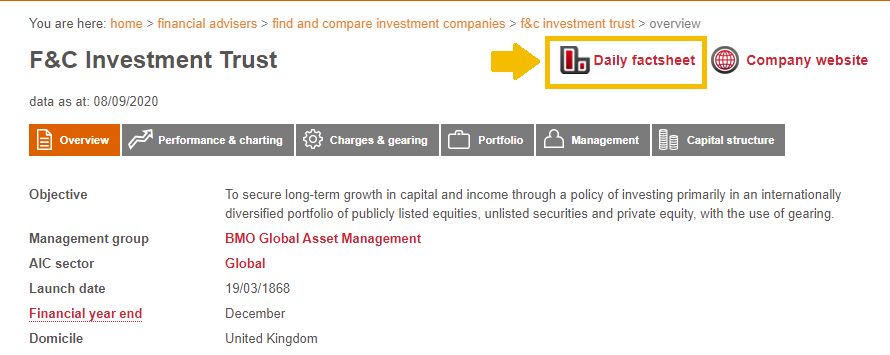

In addition to the new Investment Company Screener, the AIC has also introduced daily Morningstar factsheets on every member investment company.

When a user clicks on the daily factsheet icon on an investment company’s information page (shown below), a PDF factsheet is generated using the most recent Morningstar data for that company. This contains key statistics, performance data, risk measures and essential portfolio information such as top ten holdings and asset allocation.

An example of the daily PDF factsheet can be seen here.

-Ends-

Follow us on Twitter @AICPRESS

Notes

- The Association of Investment Companies (AIC) was founded in 1932 to represent the interests of the investment trust industry – the oldest form of collective investment. Today, the AIC represents a broad range of closed-ended investment companies, incorporating investment trusts and other closed-ended investment companies and VCTs. The AIC’s members believe that the industry is best served if it is united and speaks with one voice. The AIC’s mission statement is to help members add value for shareholders over the longer term. The AIC has 362 members and the industry has total assets of approximately £204 billion.

- Disclaimer: The information contained in this press release does not constitute investment advice or personal recommendation and it is not an invitation or inducement to engage in investment activity. You should seek independent financial and, if appropriate, legal advice as to the suitability of any investment decision. Past performance is not a guide to future performance. The value of investment company shares, and the income from them, can fall as well as rise. You may not get back the full amount invested and, in some cases, nothing at all.

- To stop receiving AIC press releases, please contact the communications team.