The true value of private equity investment trusts

Roger Pim gives his thoughts on the private equity asset class.

Roger Pim, Managing Partner, SL Capital Partners

View the Standard Life European Private Equity profile page

View the Standard Life European Private Equity profile page

Roger Pim, Managing Partner of SL Capital [the private equity arm of Standard Life Investments], provides insights into why he believes the private equity asset class can outperform listed markets in the near term as well as over the normal 3-5 year private equity investment cycle. Roger also examines why the net asset values (NAVs) of listed private equity trusts have remained robust through the recent bout of market volatility and why they should continue to grow. Finally, Roger highlights how investors can access this potential through the Standard Life European Private Equity ("SLEPET"), a listed fund-of-funds.

Robust NAVs provide buying opportunity

Private equity continues to, perhaps unfairly, create a number of negative headlines and the sector has never fully recovered from the stigma of the financial crisis. During this period, investors lost faith in the private equity model through concerns that portfolio losses would be significant and NAVs unsustainable. In fact, the opposite happened and NAVs remained robust both during and exiting the crisis.

Recent market volatility has refueled concerns about private equity investment trusts. This has led to a widening of the discounts to NAV that trusts trade on. However, we believe that NAVs are currently well supported and investors should see this as a pivotal moment to consider investing.

Correlation to less volatile listed small caps

So, what is supporting NAVs? Taking SLEPET as an example, we target private businesses with an enterprise value in the €100 million to €2.0 billion range. Businesses of this scale are equivalent to a portfolio of listed small-cap equities, which we find is closely correlated to SLEPET’s NAV. Private equity funds value their portfolio on a comparable basis to listed markets and, as shown in the chart below, the European small-cap index has outperformed large caps. We therefore estimate that recent volatility will have limited impact on SLEPET's NAV.

Source: SL Capital

Limited exposures to underperforming sectors

In addition, SLEPET has much less exposure to sectors that have underperformed recently and is underweight cyclical industries such as mining, chemicals, basic materials and capital-intensive sectors. Instead, we are currently focused on consumer goods and services, financial services, healthcare and software.

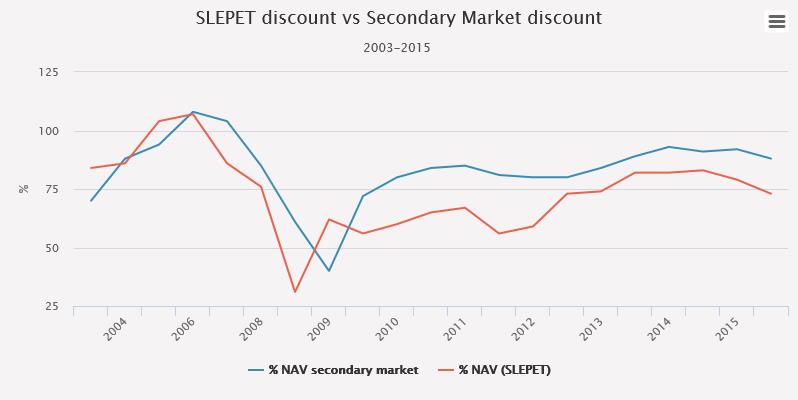

Secondary trading for private equity assets close to NAV

A key element of SLEPET’s investment strategy is buying stakes in private equity funds in the secondary market from other institutional investors. The pricing of these deals is a real proxy for fair value and the secondary market has been trading assets at around a 10% discount to NAV over the past three years. Given that SLEPET's overall discount to NAV has recently been around 30%, there is a clear dislocation in the market view on the quality of the Trust’s NAV.

Source: SL Capital

Positive uplift in valuation at exit from last NAV

When looking at the exits from our mature portfolio a constant theme is the uplift in value compared with the last reported valuation. In 2015, SLEPET's portfolio exits demonstrated an average 14% value bounce. This suggests that private equity funds are therefore conservative in reporting their NAVs.

Euro strengthening is a tailwind for performance

Finally, from a currency perspective, SLEPET has faced a headwind as sterling appreciated against the euro, reducing the headline NAV return by around 5% per annum over the last three years. However, the recent strengthening of the euro has provided a NAV growth tailwind.

In conclusion, with a conviction portfolio of leading European private equity funds, SLEPET provides investors with the opportunity to take advantage of this robust NAV growth. We maintain a key group of trusted, high quality relationships and this superior selection has generated strong performance. SLEPET's NAV total return has outperformed its European peers in the LPX Europe Index over one, three, five and 10 years (as at 30 September 2015). Overall, we believe that SLEPET is an attractive investment proposition for investors with a medium to long-term investment time horizon.

Trust performance

Total Return on a bid to bid basis (as at 31 March 2016)

| 01/04/2015 to 31/03/2016 | 01/04/2014 to 31/03/2015 | 01/04/2013 to 31/03/2014 | 01/04/2012 to 31/03/2013 | 01/04/2011 to 31/03/2012 | |

|---|---|---|---|---|---|

| Fund Performance | -5.80% | 11.37% | 12.86% | 28.40% | -5.47% |

The opinions expressed are those of SL Capital as of April 2016 and are subject to change at any time due to changes in market or economic conditions.

This material is for informational purposes only. This should not be relied upon as a forecast, research or investment advice.

The value of an investment can fall as well as rise and is not guaranteed – an investor may get back less than he/she put in. Past performance is not a guide to future performance.