Six reasons to invest in Europe

John Bennett and Tim Stevenson on what makes Europe attractive.

John Bennett, Manager, Henderson European Focus and Tim Stevenson, Manager of Henderson EuroTrust

View the Henderson European Focus profile page

View the Henderson European Focus profile page

View the Henderson EuroTrust profile page

We believe the European market is a fertile hunting ground for investment opportunities. The market’s depth and breadth, with its regional variations and, at times, political uncertainty, means we have plenty of choice when it comes to picking stocks. Here we explore some of the factors that make Europe attractive.

The ECB’s continuing support

The euro area could claim only but a few fans a year ago. Investors fretted over deflation and depression, spurred, ironically, by the collapse in oil prices. What followed was a European Central Bank (ECB) showing willingness to explore extraordinary monetary policy measures, beginning a massive quantitative easing programme, initially involving monthly injections of €60 billion into the system and recently increasing to €80bn, through the purchasing of government and corporate debt with the aim of driving down interest rates, stimulating bank lending, getting the Eurozone economy moving again, boosting investment, creating jobs, and fighting off the spectre of deflation.

While not the saviour of Europe’s underlying structural problems, Europe’s markets appear set to benefit further from the ECB’s continuing loose monetary policies, with inflation well below the central bank’s target of 2% and QE likely ending in 2017, coming right at the point when the US and UK are on course to diverge and tighten theirs.

Currency weakness is helping all round

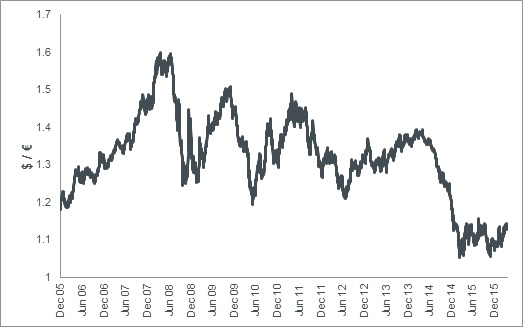

The ECB’s action has coincided with a substantial fall in the value of the euro. The chart demonstrates the Euro’s value against the dollar:

Chart 1 – The value of the euro against the dollar remains low relative to history

Source: Thomson Reuters Datastream, as at 18 April 2015

This is a great stimulus for European exporters, whose products and services become cheaper and more competitive in overseas markets, boosting exports to the US and UK at the same time as insulating others against the downturn in emerging markets. Ultimately this should feed through to better sales and profits.

Low oil prices

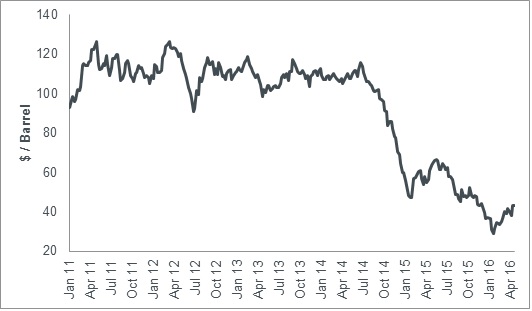

A sustained period of low oil prices would be a major positive for most European economies, putting more money into the pockets of consumers, while also helping to reduce the region’s notoriously high energy costs – Europe is the world’s largest net importer of oil and related products (approximately $406 billion in 2014). There are concerns, however, that lower oil prices could fuel a deflationary trend, while falling oil prices have had a negative impact on oil producers and oil services companies based in Europe.

Chart 2 – Falling oil prices - good for businesses and consumers, but possibly deflationary

Source: Datastream, Brent crude oil price, US dollars per barrel, as at 18 April 2016

Valuations remain relatively attractive when compared to the US

As mentioned, Eurozone stock markets have had a great run, and they’re certainly no longer as cheap as they’ve been in recent years. However, says Jason Hollands of broker Tilney Bestinvest, they remain “relatively attractive compared to US shares”.

Stock-picking remains key. The prodigious appetite for alternative income amid low yields and low interest rates, not-to-mention also quality stocks, means price ratios, a measure of how expensive stocks are relative to history, are being propelled ever higher. Rising share prices also mean fund managers need to be increasingly selective in building their portfolios – so it makes all the more sense to channel your money through a highly regarded European manager with a reputation for successful stock-picking.

Indeed, John Bennett, European fund manager at Henderson Global Investors, believes stock-picking is set to become all the more important in coming months.

“2016 has already seen a significant pick-up in volatility, so investors should brace themselves for difficult markets”, he says. “That is why I think stock picking is so important. By understanding a company’s strengths and weaknesses, we can seek to be better positioned than the general market both in good times and bad.”

Companies have reach beyond Europe

The global reach of European companies is evident in the breadth of their sources of revenue, with European-listed businesses deriving just over half of their revenues from overseas. This allows European fund managers to pick the companies with exposure to the regions with the most compelling opportunities – both domestic and global. It means that if the businesses are well managed ones – which our fund managers aim to pick – they can continue to outperform in falling as well as rising markets.

Companies are buying one another

Merger and acquisition (M&A) activity picked up steadily in 2015 and has continued into 2016, with Europe registering its highest level of deal activity since the 2007/2008 financial crisis. CEOs tend to open-up their corporate wallets when they’re feeling more confident about the business environment or the economy or when finance is cheap. In Europe deal volumes have been boosted by a combination of low oil prices, the strong US dollar and optimism about Europe’s economic prospects - a positive sign.