The most cost-effective platforms for investment companies

New AIC research, conducted by the lang cat, reveals the costs of holding and transacting investment companies on adviser platforms.

This article was updated on 09/01/18.

We’re often asked by advisers which are the best platforms for holding investment companies. Clearly, ‘best’ may not mean ‘cheapest’, but looking at costs is a start. We thought it would be nice if we could give advisers and wealth managers an idea of how their choice of platform might affect the costs borne by their clients when investing in investment companies. The research, conducted by platform consultancy the lang cat, is published here for the first time.

We’re often asked by advisers which are the best platforms for holding investment companies. Clearly, ‘best’ may not mean ‘cheapest’, but looking at costs is a start. We thought it would be nice if we could give advisers and wealth managers an idea of how their choice of platform might affect the costs borne by their clients when investing in investment companies. The research, conducted by platform consultancy the lang cat, is published here for the first time.

Before we get to the nitty gritty, here’s a table of the different adviser platforms covered by the research. (If you want to skip straight to the cost info, here's the link).

| Adviser platform | Basic SIPP | Full SIPP | ISA | Junior ISA | Flexible ISA | Lifetime ISA | Onshore bond | Offshore bond |

|---|---|---|---|---|---|---|---|---|

| Aegon Retirement Choices | On platform | ✘ | ✔ | ✘ | ✘ | In development | ✘ | On platform |

| AJ Bell Investcentre | On platform | On platform | ✔ | ✔ | ✘ | In development | ✘ | Linked to platform |

| Alliance Trust Savings | On platform | ✘ | ✔ | ✔ | ✘ | In development | ✘ | ✘ |

| Ascentric | On platform | ✘ | ✔ | ✔ | ✘ | In development | Linked to platform | Linked to platform |

| Aviva Platform | On platform | On platform | ✔ | ✘ | ✔ | ✘ | Linked to platform | ✘ |

| Cofunds | On platform | Linked to platform | ✔ | ✘ | ✘ | In development | On platform | Linked to platform |

| Elevate | On platform | ✘ | ✔ | ✘ | ✘ | ✘ | ✘ | Linked to platform |

| FundsNetwork | On platform | ✘ | ✔ | ✘ | ✘ | In development | ✘ | On platform |

| Hubwise | Linked to platform | Linked to platform | ✔ | ✔ | ✔ | In development | ✘ | On platform |

| Novia | ✘ | On platform | ✔ | ✘ | ✔ | In development | ✘ | On platform |

| Nucleus | On platform | Linked to platform | ✔ | ✘ | ✘ | In development | On platform | On platform |

| OMW | ✘ | Linked to platform | ✔ | ✘ | ✘ | ✘ | On platform | Linked to platform |

| Praemium | Linked to platform | Linked to platform | ✔ | ✘ | ✔ | In development | ✘ | Linked to platform |

| Raymond James | On platform | ✘ | ✔ | ✔ | ✔ | In development | On platform | On platform |

| Seven IM | On platform | Linked to platform | ✔ | ✘ | ✔ | In development | ✘ | On platform |

| Standard Life Wrap | On platform | ✘ | ✔ | ✘ | ✘ | In development | On platform | On platform |

| Transact | On platform | ✘ | ✔ | ✔ | ✔ | ✔ | On platform | On platform |

| True Potential | On platform | Linked to platform | ✔ | ✔ | ✔ | In development | Linked to platform | Linked to platform |

| Zurich Intermediary Platform | On platform | ✘ | ✔ | ✘ | ✔ | In development | Linked to platform | Linked to platform |

The platform world has changed rapidly in recent years and the good news is that now all major adviser platforms except two, Cofunds and Old Mutual Wealth, offer investment companies. The table below shows whether investment companies are offered, the broker who facilitates this and whether investment companies can be held in adviser-generated model portfolios.

| Adviser platform | Investment companies | Stockbroker | Investment companies within models |

|---|---|---|---|

| Aegon Retirement Choices | ✔ | Winterflood | ✘ |

| AJ Bell Investcentre | ✔ | In-house | ✔ |

| Alliance Trust Savings | ✔ | In-house | ✔ |

| Ascentric | ✔ | In-house | ✔ |

| Aviva Platform | ✔ | Charles Stanley | ✔ |

| Cofunds | |||

| Elevate | ✔ | Winterflood | ✔ |

| FundsNetwork | ✔ | Platform Securities LLP and JP Morgan Securities Ltd | ✔ |

| Hubwise | ✔ | In-house | ✔ |

| Novia | ✔ | Winterflood/ Stocktrade | ✘ |

| Nucleus | ✔ | Stocktrade | ✔ |

| OMW | |||

| Praemium | ✔ | FNZ | ✔ |

| Raymond James | ✔ | In-house | ✔ |

| Seven IM | ✔ | In-house | ✔ |

| Standard Life Wrap | ✔ | HSBC Securities Services | ✔ |

| Transact | ✔ | Winterflood, Canaccord and Charles Stanley | ✔ |

| True Potential | ✔ | HSBC Securities Services | ✔ |

| Zurich Intermediary Platform | ✔ | Winterflood | ✔ |

Cofunds and Old Mutual both plan to offer investment companies in the near future, the former as a result of its acquisition by Aegon.

Though the increased availability of investment companies on platforms is good news, the costs for holding and dealing in them, either inside or outside models, vary a lot from one platform to another. To illustrate this, the lang cat has provided some of its trademark heatmaps, backed by painstaking research into the fine detail of the different platform charges.

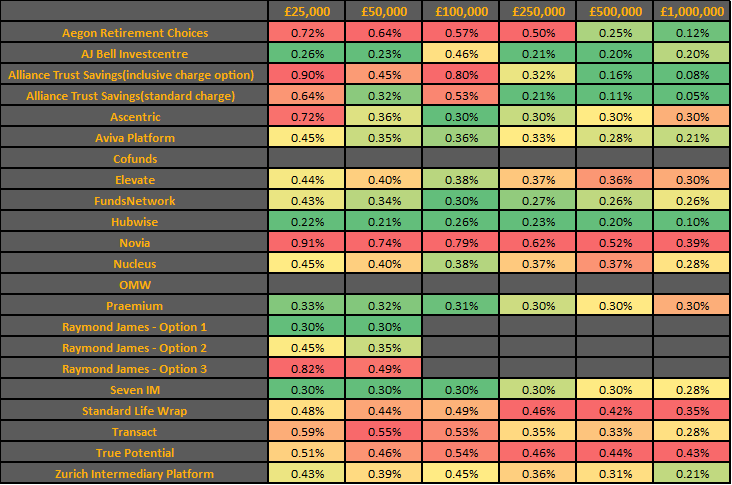

Here, for example, are the annual running costs in basis points for portfolios of different sizes invested 50/50 in open-ended funds and investment companies, with four transactions (buys or sells) a year (1). Detailed assumptions are in the footnotes to this post.

As you can see, green is cheap and red is expensive. Platform costs for maintaining a £250,000 portfolio range from 21 basis points at AJ Bell or Alliance Trust Savings to 62 basis points at Novia. That’s a difference of more than £1,000 a year.

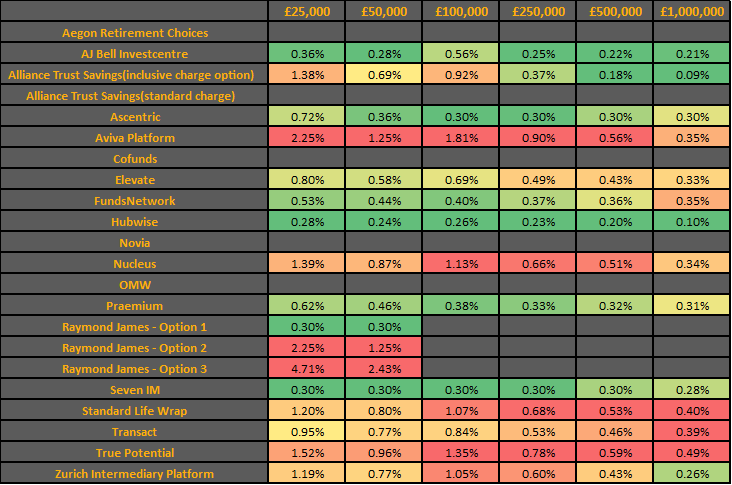

What about model portfolios? Here you will probably be paying transaction costs on rebalancing, as well as the standard custody charges. Again, the lang cat has made some common-sense assumptions (2), chiefly that the rebalancing is quarterly and the model portfolio has ten equally weighted holdings, comprising nine open-ended funds and one investment company.

For a £250,000 portfolio in this scenario, the platform with the highest charges will cost the client more than double the cheapest. Costs range from 23 basis points with Hubwise to 53 basis points with Transact.

Changing the assumptions, not surprisingly, changes the result. If we shift to a model portfolio with a 50/50 split between open-ended funds and investment companies, with five of each, then the cheapest platform is still Hubwise at 23 basis points but the most expensive is now Aviva Platform at 90 basis points.

As we said right at the start, cost is only one consideration when choosing a platform, but it is an important one. We hope this research will help advisers save money for their clients while ensuring that they remain invested in the best and most suitable products – which may well include investment companies.

Notes

- The table looks at the cost of investing on platform for one year. Calculations include ongoing platform fees, any additional wrapper charges and trading where applicable. Where assets under administration (AUA) are £50,000 or less, it’s been assumed that the client is investing in an ISA. Above this level, a split of 25/25/50% in an ISA/general investment account/pension has been used. Raymond James does not have an on-platform pension, therefore it has not been included in the mixed wrapper calculations. The table assumes 50/50% investment in investment companies and funds, with ten equal holdings, making two transactions (buys or sells) of each investment type in the year. Data is based on publicly available charging structure information with some details verified via conversations with platforms. Last updated 05/01/18.

- The notes above apply, except that the table assumes a model portfolio with ten equal holdings, where nine are funds and one is an investment company. Rebalancing is quarterly to correct a 2% drift. Data is based on publicly available charging structure information with some details verified via conversations with platforms. Last updated 05/01/18.