How well do you know your alternatives?

The prominence of alternative assets has grown dramatically in recent years.

There’s nothing new about alternatives. People have been investing in businesses and property forever, even if they didn’t call it private equity and real estate.

There’s nothing new about alternatives. People have been investing in businesses and property forever, even if they didn’t call it private equity and real estate.

It’s the prominence of these asset classes that’s grown. Alternative assets under management have now topped £7 trillion, according to data from research firm Preqin, and the vast majority of institutional investors are looking to maintain or increase their exposure to asset classes including private equity (95%), infrastructure (94%) and debt (95%).

Alternatives are no longer the preserve of institutions. There are several ways for clients to gain exposure, with closed-ended investment companies in the UK managing over £72 billion of assets in private equity, infrastructure, debt and other specialist asset classes.

Clearly, not all alternatives are alike. There are major differences not just between alternative asset classes but within them. To help explore these issues, the Association of Investment Companies (AIC) is running two seminars in the autumn for financial advisers and wealth managers who wish to understand more.

The AIC has also been reviewing and refining its sector classifications to keep pace with the rapid development of alternatives. For example, it has split its old ‘Debt’ sector into three new sectors covering direct lending, loans and bonds, and structured finance. The direct property sectors have also had a makeover, while there are some completely new sectors, such as Growth Capital and Royalties. The latter is home to Hipgnosis Songs Fund, which invests in hit songs from the likes of Beyonce and Chic, and benefits from the associated royalty payments.

Choosing the right structure

Interest in alternative assets extends beyond the closed-ended sector. The recent suspension of LF Woodford Equity Income highlighted how an open-ended fund had become exposed to illiquid assets (in this case, unquoted companies). Billions of pounds are invested in open-ended property funds which offer redemption at NAV in normal market conditions but suspend trading when markets are stressed – after the EU referendum vote, for example, or in the global financial crisis.

To deal with these issues, the Investment Association (IA) has recently proposed the creation of a new type of open-ended fund, which would offer limited or delayed redemption opportunities. The theory is that so-called “long-term asset funds” would be better able to handle illiquid assets, because they would not have to redeem units on a daily basis.

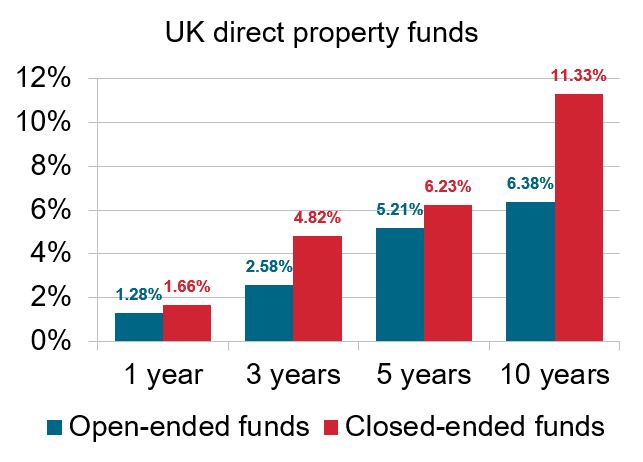

However, the AIC believes that such proposals do not address the systemic problems raised by investment in illiquid alternatives within an open-ended structure. The closed-ended structure is the obvious vehicle for illiquid asset investment because it gives fund managers the benefit of ‘permanent capital’ while allowing investors to continue to trade (through the stock market) in stressed market conditions.

Source: AIC/Morningstar (to 30/4/19). Share price total returns (unweighted) of IA UK Direct Property and AIC Property – UK Commercial sectors.

The AIC’s chief executive, Ian Sayers, said in response to the IA’s proposals: “There are many commercial reasons why asset managers favour open-ended funds over closed-ended funds, even when it is clear that the closed-ended structure is better suited to illiquid assets. We believe the time has come to put consumers’ interests first.”

The debate about whether private investors should have exposure to alternative assets (and how much), and the most suitable structures to gain this exposure, looks set to continue.

The AIC Alternatives Seminars will be held in Birmingham on 18 September and London on 10 October. Find out more and book a free place.