AIC publishes research into costs of holding investment companies on adviser platforms

Research conducted by the lang cat, reveals the most cost-effective platforms for clients holding investment companies.

- 17 adviser platforms covered

- Costs of ad hoc trading and model portfolio rebalancing are both considered

The Association of Investment Companies (AIC) has released research that aims to provide a comprehensive view of the platform costs associated with using investment companies in clients’ portfolios.

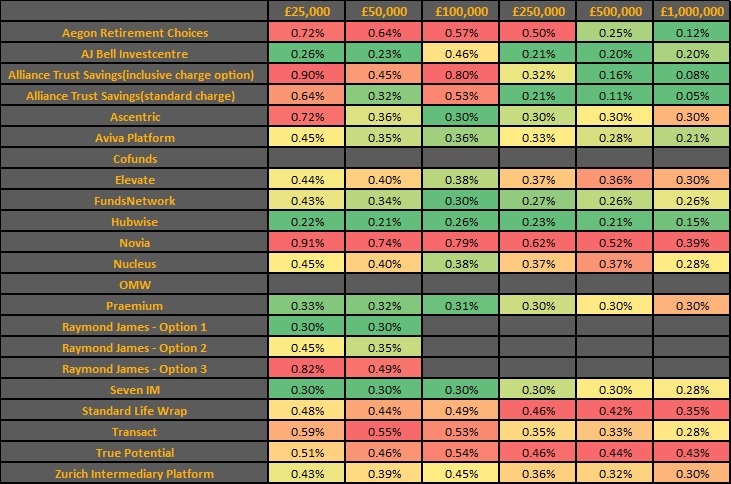

Conducted by the lang cat, a platform consultancy, the research reveals the costs of holding portfolios of investment companies between £25,000 and £1 million on 17 different adviser platforms. It also casts light on the costs of trading investment companies within model portfolios, and shows which platforms have in-house dealing desks.

Platform charges are split into ongoing costs (also known as admin costs or custody costs) and transaction costs for buying or selling investment company shares.

Ongoing costs are generally levied as a percentage of client assets, though Alliance Trust Savings has a flat fee model. Costs for trading investment companies vary widely. Two platforms, Ascentric and Seven IM, do not charge for trades, while Raymond James and Alliance Trust Savings offer a charging option where trades are included. Otherwise, trading costs can be as little as £2 or as much as £25, or even more for large transactions.

Commenting on the research, Nick Britton, Head of Training at the Association of Investment Companies (AIC) said: “We’re often asked by advisers which are the best platforms for holding investment companies. While best doesn’t always mean cheapest, we’ve launched this research with the lang cat to help advisers navigate what can be a complex array of charging options and work out which platforms will be most cost-effective for their clients.

“The good news is that investment companies are now available on more adviser platforms than ever before, and on 15 out of the 17 platforms where they are offered, can be held in model portfolios. However, not all platforms will be cost-effective for all clients, so care needs to be taken to choose the right one.”

Steve Nelson, Head of Research at the lang cat, which conducted the research, said: “Cost is clearly only one aspect of a wider platform selection or due diligence exercise. But what we’ve found from our research with the AIC is that there is clear segmentation within the platform market. One of the original visions of the platform market was a wrapper and investment neutral environment. It’s fair to say it’s not quite panned out like that.

“However, if advisers are looking to include investment companies within an investment proposition, then there are a handful of platforms - typically those with in-house dealing desks - where trading costs are not a barrier.”

What’s in the research

The research includes:

- a table showing the 19 major adviser platforms, indicating which offer investment companies, and which of these allow inclusion in model portfolios

- a table detailing the charges for holding and transacting investment companies on platforms, including charges for rebalancing within model portfolios

- ‘heatmaps’ indicating annual platform charges as a % of client assets in a range of common scenarios

For example, the following heatmap shows the cost of a portfolio invested 50/50% in open-ended funds and investment companies, with four transactions (buys or sells) a year*. The colour of each cell indicates relative cost, where green is cheaper and red is more expensive.

As can be seen from the heatmap, the costs for maintaining a £250,000 portfolio invested in this way range from 0.21% of client assets at AJ Bell or Alliance Trust Savings to 0.62% at Novia, a difference of more than £1,000 a year.

Annual platform costs of investing in portfolios including investment companies*

The full research is published on the AIC website and will be updated as and when platforms amend their charging schedules, with the aim of providing a valuable up-to-date information resource for the increasing number of advisers who use investment companies.

In the first half of 2017, purchases of investment companies on adviser platforms reached a record high of £513 million, according to data from Matrix Financial Clarity.

* The heatmap looks at the cost of investing on each platform for one year. Calculations include ongoing platform fees, any additional wrapper charges and trading where applicable. Where assets under administration (AUA) are £50,000 or less, it’s been assumed that the client is investing in an ISA. Above this level, a split of 25/25/50% in an ISA/general investment account/pension has been used. Raymond James does not have an on-platform pension, therefore it has not been included in the mixed wrapper calculations. Cofunds and Old Mutual Wealth do not currently offer investment companies. The heatmap assumes 50/50% investment in investment companies and funds, with ten equal holdings, making two transactions (buys or sells) of each investment type in the year. Data is based on publicly available charging structure information with some details verified via conversations with platforms in August 2017. Source: AIC/the lang cat.

Notes

- The Association of Investment Companies (AIC) was founded in 1932 to represent the interests of the investment trust industry – the oldest form of collective investment. Today, the AIC represents a broad range of closed-ended investment companies, incorporating investment trusts and other closed-ended investment companies and VCTs. The AIC’s members believe that the industry is best served if it is united and speaks with one voice. The AIC’s mission statement is to help members add value for shareholders over the longer term. The AIC has 352 members and the industry has total assets of approximately £174 billion.

- The lang cat is a platform, pensions and investment specialist, supplying consultancy, PR and strategic communications across the financial services industry. Find out more at www.langcatfinancial.co.uk.

- Disclaimer: The information contained in this press release does not constitute investment advice or personal recommendation and it is not an invitation or inducement to engage in investment activity. You should seek independent financial and, if appropriate, legal advice as to the suitability of any investment decision. Past performance is not a guide to future performance. The value of investment company shares, and the income from them, can fall as well as rise. You may not get back the full amount invested and, in some cases, nothing at all.