AIC Adviser Income Survey

Advisers differ on best income strategies, according to AIC research.

There is no overall consensus on the best strategy to use to secure clients an income in retirement, according to a survey of 192 advisers conducted for the Association of Investment Companies by the lang cat.

There is no overall consensus on the best strategy to use to secure clients an income in retirement, according to a survey of 192 advisers conducted for the Association of Investment Companies by the lang cat.

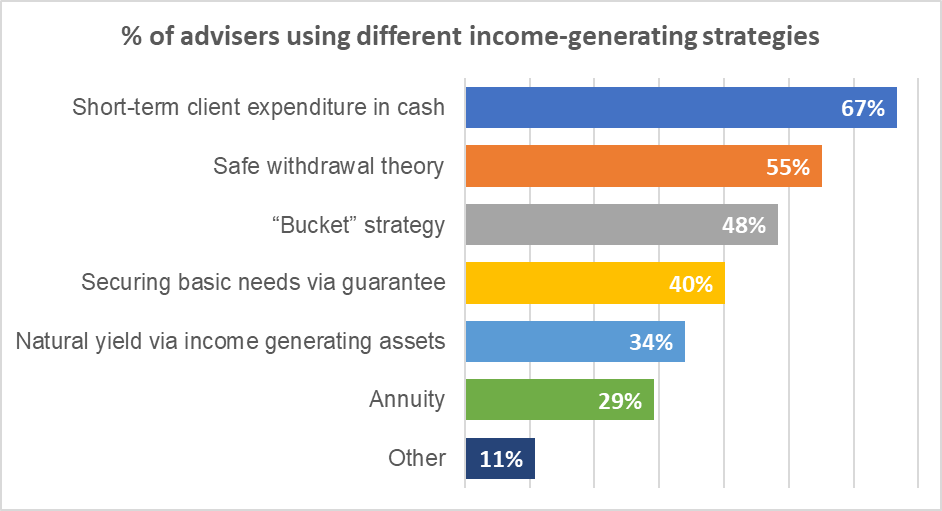

The most common strategy, used by 67% of advisers, is to recommend that their clients hold cash to fund short-term expenditures.

Safe withdrawal theory is favoured by 55% of advisers, and a ‘bucket strategy’ by 48%. The next most popular approach is to secure basic client needs via guarantee, with 40% of advisers using this strategy, followed by a ‘natural income’ approach using yield-generating assets, used by 34% of those surveyed. Annuities were the least popular of the strategies named in the survey (29%) reflecting the low rates on offer.

Source: AIC/the lang cat (fieldwork conducted in July and August 2020)

A majority of advisers who answered the survey (61%) agreed that investment companies offer tangible income benefits, such as the ability to smooth dividends by reserving some income. Less than a fifth of respondents (18%) disagreed with this statement while the remaining 21% were unsure.

However, most survey respondents (79%) did not use investment companies. A further 5% said they do use them but only as part of another product, such as a DFM’s model portfolio or multi-asset fund, while 16% recommended investment companies directly.

Reasons stated by respondents for not using investment companies included their perceived complexity and risk, and the tendency to trade at discounts and premiums.

Benefits of investment companies stated by respondents who did use them included the ability to reserve income to smooth dividends, the additional diversification offered by less liquid asset classes and investment companies’ consistent performance over time.

Nick Britton, Head of Intermediary Communications at the Association of Investment Companies (AIC), said: “This research sheds light on advisers’ preference for different income-generating strategies. No single strategy has eclipsed the others, and it’s clear that advisers will often use different strategies for different clients, rather than adopting a one-size-fits-all approach.

“Most advisers recognise the ability of investment companies to smooth dividends by reserving income as a key benefit of the structure. For those who use natural income strategies, investment companies can provide a reliable (though not guaranteed) income stream with the prospect of growing income over time.”

More insight into advisers’ use of investment companies in model portfolios can be found in the lang cat’s recent research paper, Practically Speaking: Investment companies within centralised investment propositions.

The revenue reserve

Investment companies are able to reserve up to 15% of the income they receive from their portfolio in any year. The reserved income goes into a ‘revenue reserve’, and can be used for topping up dividends in future years.

This structural feature of investment companies has enabled many of them to build up multi-decade records of dividend increases. For example, 18 investment companies (called “dividend heroes”) have increased their dividends every year for at least the last 20 years. A full list of dividend hero investment companies can be found here.

A minority of investment companies also seek to increase the income they provide by paying dividends out of capital profits they have made on their investments. For UK investment trusts, this has been possible since 2012.

- ENDS -

Follow us on Twitter @AICPRESS

Notes to editors

- The lang cat surveyed 192 members of its adviser panel in July and August 2020. The survey also fed into the research paper Practically Speaking: Investment companies within centralised investment propositions, which builds on the lang cat’s previous research conducted for the AIC including We Have Trust Issues and You Can Do It.

- The Association of Investment Companies (AIC) was founded in 1932 to represent the interests of the investment trust industry – the oldest form of collective investment. Today, the AIC represents a broad range of closed-ended investment companies, incorporating investment trusts and other closed-ended investment companies and VCTs. The AIC’s members believe that the industry is best served if it is united and speaks with one voice. The AIC’s mission statement is to help members add value for shareholders over the longer term. The AIC has 358 members and the industry has total assets of approximately £209 billion.

- Disclaimer: The information contained in this press release does not constitute investment advice or personal recommendation and it is not an invitation or inducement to engage in investment activity. You should seek independent financial and, if appropriate, legal advice as to the suitability of any investment decision. Past performance is not a guide to future performance. The value of investment company shares, and the income from them, can fall as well as rise. You may not get back the full amount invested and, in some cases, nothing at all.

- To stop receiving AIC press releases, please contact the communications team.