VCTs’ vital role supporting small businesses through the pandemic

In H1 2020 VCTs invested £695 million in small UK businesses.

In H1 2020 VCTs invested £695 million in small UK businesses.

Today, the Association of Investment Companies (AIC) released the report, 'Eager beavers: Enhancing the UK's commercial ecosystem'. The report examines VCT investment since the 2017 rule changes which directed VCTs towards higher-risk investment.

Richard Stone, Chief Executive of the Association of Investment Companies (AIC), said: “This report demonstrates the valuable role VCTs have played in supporting the UK’s SMEs through the pandemic. As the UK looks to build back a more stable and competitive economy, VCTs have a vital part to play in the business ecosystem making significant investments in ambitious young companies. VCTs support a wide range of SMEs, from healthcare to technology and generate new jobs to help create a more resilient and responsive economy. Their unique contribution makes a compelling case for VCTs to receive continued backing from the government and policymakers across the political spectrum.”

The report reveals the important role that VCTs have played in supporting SMEs through the pandemic. In H1 2020, VCTs have invested £695 million in small UK businesses, including £219 million in follow-on investment. The ability of VCTs to provide ongoing support to businesses is one of the sector’s key advantages and since the scheme was adapted in 2017 to maintain its focus on higher risk investments, VCTs have invested £1.6 billion in small and medium sized-enterprises (SMEs).

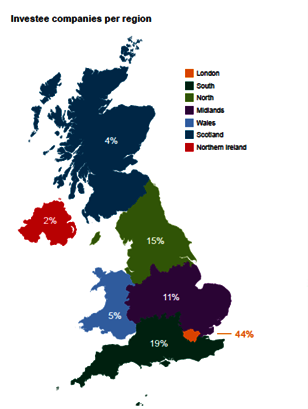

The report found that an estimated 112 (36%) VCT-backed businesses are knowledge intensive companies while 56% of VCT investment was directed outside London. The report contains 42 case studies of companies that have received investment since the 2017 rule changes, including biotechnology, artificial intelligence and digital technology.

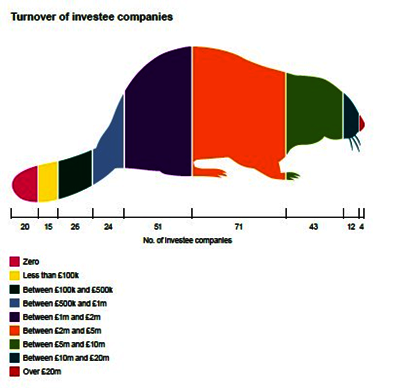

Of 266 investee companies surveyed, 71 had a turnover of between £2 million and £5 million when the survey data was collated. 16 VCT-backed companies had a turnover greater than £10 million, while four exceeded £20 million. This demonstrates how VCTs are supporting companies in the early stages of their development.

Key findings of the report:

- At the time the survey data was collated, 16 VCT-backed companies had turnover greater than £10 million.

- 30% of investee company turnover was earned overseas.

- The total number of people employed by 288 SMEs surveyed was approaching 14,000.

- £357 million was invested in R&D by 181 companies in the last financial year.

- 181 companies reported R&D spending averaging £1.97 million per SME.

For more information on VCTs, view the AIC’s video: Venture Capital Trusts Explained or guide: Going for Growth

- ENDS -

Follow us on Twitter @AICPRESS

Notes to editors

- The survey period covered investments made after 4 December 2017 up to the end of June 2020. It does not capture all investments made as submission dates for data varied.

- The Association of Investment Companies (AIC) was founded in 1932 to represent the interests of the investment trust industry – the oldest form of collective investment. Today, the AIC represents a broad range of closed-ended investment companies, incorporating investment trusts and other closed-ended investment companies and VCTs. The AIC’s members believe that the industry is best served if it is united and speaks with one voice. The AIC’s mission statement is to help members add value for shareholders over the longer term. The AIC has 364 members and the industry has total assets of approximately £265 billion.

- Disclaimer: The information contained in this press release does not constitute investment advice or personal recommendation and it is not an invitation or inducement to engage in investment activity. You should seek independent financial and, if appropriate, legal advice as to the suitability of any investment decision. Past performance is not a guide to future performance. The value of investment company shares, and the income from them, can fall as well as rise. You may not get back the full amount invested and, in some cases, nothing at all.

- To stop receiving AIC press releases, please contact the communications team.