Only 1% of financial advisers and wealth managers completely trust funds’ sustainability claims

Support of ESG investing as a concept remains strong despite perfect storm of 2022

Just 1% of financial advisers and wealth managers “completely trust” sustainability claims from funds, according to research from the Association of Investment Companies (AIC).

Financial advisers and wealth managers were asked to rate their trust in funds’ sustainability claims on a scale of 1 (do not trust at all) to 5 (completely trust). Only 1% of respondents responded with a ‘5’ score, while the majority (56%) responded with ‘3’, indicating limited trust.

The research among 200 intermediaries (109 financial advisers and 91 wealth managers) was conducted for the AIC by Research in Finance1.

Fears of greenwashing could be allayed by more specific information, including examples. One wealth manager said: “I would need to see real examples in the portfolio. I would need them to say, ‘We looked at company X last year. We really, really liked it. It scored really well on all our stuff but then when we thought about it from a sustainable point of view, we didn't invest in it.’”

Support for ESG investing remains strong

Despite scepticism about ESG claims, financial advisers and wealth managers remain supportive of ESG investing. About four-fifths (79%) agreed that “investments should make a positive difference as well as a financial return”.

Nearly half of respondents (48%) consider their firm to have been an “early adopter” of ESG investing, a further 31% said their firm had recently bought into the value of ESG, while only 1% said ESG was “not something my firm is interested in”2. The number of firms considering themselves “early adopters” has increased from 37% when this research was conducted last year3, to 48% this year.

A perfect storm

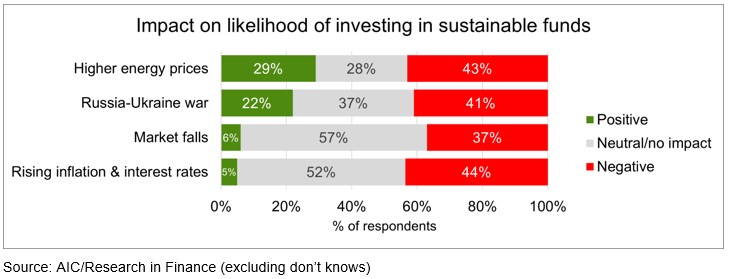

2022 has created a perfect storm for sustainable investing. Significant numbers of financial advisers and wealth managers said that higher energy prices, the Russia-Ukraine war, market falls and rising inflation and interest rates have had a negative impact on their likelihood to invest in sustainable funds over the next 12 months.

Advisers and wealth managers are more pessimistic about the likely performance, risk and charges of ESG-oriented funds than they were last year.

While 47% of last year’s respondents thought that ESG investing was more likely to improve performance, that had shrunk to 36% this year.

A majority (61%) of respondents now think ESG investing will lead to higher charges, compared to 46% last year.

And 45% of respondents in this year’s survey said ESG investing is likely to lead to higher risk, compared with 32% in 2021.

Nevertheless, advisers and wealth managers still expect demand for ESG investing to increase at least a little over the next 12 months, even if the percentage who expect it to “increase significantly” has halved from 38% in last year’s survey to 19% in the more recent wave4.

Nick Britton, Head of Intermediary Communications at the Association of Investment Companies (AIC), said: “Advisers and wealth managers are overwhelmingly on board with ESG and sustainable investing, but they’re also keenly aware of the risks of greenwashing with only 1 in 100 completely trusting ESG claims from funds. In the light of this, the FCA’s decision to impose stringent rules on how funds present their sustainability claims looks timely, and it’s one we fully support.

“ESG investing has faced a perfect storm this year, and this has clearly affected expectations about performance and risk. Market falls, higher inflation and the war in Ukraine have made many advisers and wealth managers more wary of investing in sustainable funds in the short term, though they still expect demand for ESG investing in general to increase over the next 12 months.”

- ENDS -

Follow us on Twitter @AICPRESS

Notes to editors

- An online survey of 200 retail intermediaries (109 financial advisers and 91 wealth managers) was commissioned by the Association of Investment Companies (AIC) and conducted by Research in Finance. This was followed by in-depth interviews with ten selected respondents (seven financial advisers and three wealth managers). The fieldwork was conducted between 11 and 31 July 2022. A breakdown of responses by job role (financial adviser versus wealth manager) is available on request.

- In answer to the question “Which of the following best represents your firm’s experience in, and attitude towards, ESG investing?”, responses were as follows: 48% selected “My firm was an early adopter of ESG investing and has offered an ESG investment proposition for some years now”; 31% selected “My firm has recently bought into the value of ESG investing and now has an ESG investment proposition”; 17% selected “My firm is interested in ESG investing and is looking to offer an ESG investment proposition in the future”; 4% selected “My firm has not thought about ESG investing too much but is planning to look at this now / in the near future”; and 1% selected “ESG investing is not something my firm is interested in”.

- Last year’s wave of this research was conducted between 27 July and 31 August 2021.

- In this year’s research, 19% of respondents expected demand for ESG investing to increase significantly over the next 12 months, 61% expected it to increase a little, 16% expected no change, 4% expected demand to decrease a little, and 1% expected it to decrease significantly. Last year (2021) the corresponding percentages were as follows: 38%, 54%, 7%, 1% and 0%.

- The Association of Investment Companies (AIC) was founded in 1932 to represent the interests of the investment trust industry – the oldest form of collective investment. Today, the AIC represents a broad range of closed-ended investment companies, incorporating investment trusts and other closed-ended investment companies and VCTs. The AIC’s members believe that the industry is best served if it is united and speaks with one voice. The AIC’s vision is for closed-ended investment companies to be considered by every investor. The AIC has 354 members and the industry has total assets of approximately £262 billion.

- For more information about the AIC and investment companies, visit the AIC’s website.

- Disclaimer: The information contained in this press release does not constitute investment advice or personal recommendation and it is not an invitation or inducement to engage in investment activity. You should seek independent financial and, if appropriate, legal advice as to the suitability of any investment decision. Past performance is not a guide to future performance. The value of investment company shares, and the income from them, can fall as well as rise. You may not get back the full amount invested and, in some cases, nothing at all.

- To stop receiving AIC press releases, please contact the communications team.