Debt investment companies grow 493% in ten years

But what is driving their popularity and what do they actually do?

Debt has been one of the fastest growing areas of the investment company industry over the past ten years, offering high levels of income in an era of ultra-low interest rates.

Debt has been one of the fastest growing areas of the investment company industry over the past ten years, offering high levels of income in an era of ultra-low interest rates.

Debt investment companies now represent £9.1bn in total assets across 31 companies in the three debt sectors, Debt – Direct Lending, Debt – Loans & Bonds and Debt – Structured Finance. This represents growth of 493% over ten years, since debt investment companies managed £1.5bn in assets in July 2009*.

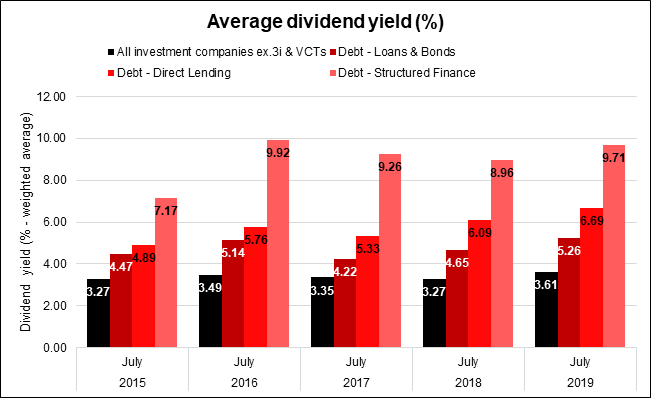

The chart below shows the generous yields on offer from debt investment companies. Whilst this high income can be appealing, along with the opportunity for diversification, investors need to understand these companies present higher risks and rewards than mainstream bonds.

Some of the terminology around debt can be hard to understand, and so to help investors the Association of Investment Companies (AIC) has provided a description of each of the debt sectors, together with explanations from managers of their various strategies.

Weighted average yield of companies in the investment company debt sectors versus all investment companies ex. 3i and VCTs. Source: AIC/Morningstar.

Debt – Direct Lending

Investment companies in the Debt – Direct Lending sector invest in loans made to companies by organisations other than banks. The lending organisations can include the investment companies themselves, peer-to-peer platforms or specialist asset managers.

Example – Biopharma Credit

Pedro Gonzalez de Cosio, Investment Manager of BioPharma Credit, said: “BioPharma Credit is a specialist debt investor that provides loans to life sciences companies secured by intellectual property and cash flows from marketed products.”

What does it offer?

“BioPharma Credit’s objective is to offer long-term shareholder returns predominantly through regular dividend payments derived from the company’s positions in the life sciences industry. The targeted annual dividend is 7 cents per share with a net total return on NAV of 8-9%. These returns are expected to be uncorrelated to equity market movements and so serve as a regular and defensive source of income for investors. Through the detailed research of a highly experienced sector investment team and careful due diligence, the investment manager offers investors the security of a carefully selected diverse portfolio with downside protection and stable cash flows to support the company’s quarterly dividend to shareholders.”

Debt – Loans & Bonds

Investment companies in the Debt – Loans & Bonds sector invest in bonds, syndicated loans (where several lenders combine to offer a large loan) and other types of loans which are likely to be traded between investors.

Example – City Merchants High Yield

Rhys Davies, Portfolio Manager of City Merchants High Yield, said: “City Merchants High Yield invests in high yield bonds issued by companies from a wide variety of industries including banking, telecoms, insurance and food.”

What does it offer?

“The trust’s objective is to obtain both high income and capital growth for investors, and is invested with a dividend target in mind. For several years the trust has paid 10 pence per annum in dividends, providing investors with a stable and attractive income in a low yielding environment.”

Debt – Structured Finance

Structured finance is a way of providing funding to large companies which often have complex funding needs. A structured finance provider can package a group of loans into a single product.

Investment companies in the Debt – Structured Finance sector invest in these products or portions of them known as tranches. They include Asset Backed Securities (ABS) and Collateralised Debt Obligations (CDOs).

Example – TwentyFour Income

Ben Hayward, Portfolio Manager of TwentyFour Income, said: “TwentyFour Income invests in less liquid, higher yielding UK and European asset backed securities. This includes the major sectors such as Residential Mortgage Backed Securities and Collateralised Loan Obligations where the level of liquidity might be driven by tranche size, issuer or geography, but also private transactions, smaller unrated deals, and warehouses where there is deemed to be a yield premium that can be extracted by the company.”

What does it offer?

“The fund has consistently provided an attractive income proposition as well as a capital gain opportunity, and it has done this with a NAV that has been uncorrelated to other asset classes. The company’s income returns seek to effectively track base rates as the majority of the portfolio offers a floating rate return, but with a minimum 6p per share dividend policy and a commitment to distributing all income earned. The company fully hedges all currency risk.”

Annabel Brodie-Smith, Communications Director of the Association of Investment Companies (AIC), said: “Debt has been one of the fastest growing areas of the investment company industry. Investors seeking income have been attracted by the generous yields achieved through a wide range of different strategies including corporate, asset-backed, distressed and peer-to-peer loans. Many of these strategies are based on hard-to-trade assets and can only work within the closed-ended structure of investment companies, where these assets can be held without the risk of suspensions or forced sales.

“Clearly, these assets present very different risks and rewards from mainstream bonds and investors need to understand this before investing. While the yields are attractive for income seekers, debt investment companies should only be considered as part of a balanced, long-term portfolio. If investors are in any doubt as to whether investment companies are suitable for them they should speak to a financial adviser.”

-Ends-

Follow us on Twitter @AICPRESS

Notes

- * Debt investment companies (across all debt sectors) managed £9.118 billion of assets at the end of July 2019, compared to £1.537 billion of assets at the end of July 2009, an increase of 493%. Property – Debt has not been categorised as a debt sector for the purposes of this study.

- The Association of Investment Companies (AIC) was founded in 1932 to represent the interests of the investment trust industry – the oldest form of collective investment. Today, the AIC represents a broad range of closed-ended investment companies, incorporating investment trusts and other closed-ended investment companies and VCTs. The AIC’s members believe that the industry is best served if it is united and speaks with one voice. The AIC’s mission statement is to help members add value for shareholders over the longer term. The AIC has 359 members and the industry has total assets of approximately £200 billion.

- Disclaimer: The information contained in this press release does not constitute investment advice or personal recommendation and it is not an invitation or inducement to engage in investment activity. You should seek independent financial and, if appropriate, legal advice as to the suitability of any investment decision. Past performance is not a guide to future performance. The value of investment company shares, and the income from them, can fall as well as rise. You may not get back the full amount invested and, in some cases, nothing at all.

- To stop receiving AIC press releases, please contact the communications team.