AIC review highlights case for VCTs as providers of patient capital

See AIC research on VCT investment.

- Download AIC VCT review: "Transforming small business”

- Download HM Treasury's "Patient Capital" consultation paper

The Association of Investment Companies’ (AIC) review of Venture Capital Trusts (VCTs), ‘Transforming small business’, highlights the role VCTs play in providing patient capital to UK businesses. This is particularly relevant as HM Treasury is currently conducting a review, ‘Financing Growth in Innovate Firms’, which is considering how the UK investment community can support growing innovative firms by providing increased access to long-term investment (patient capital).

The AIC research demonstrates that VCTs enable UK businesses to more than double their turnover (an increase of £2.2 million per £1 million of VCT investment) and that VCTs’ investment has created 27,000 jobs. The AIC’s review shows that 54% of all current VCT investee businesses have been held by those VCTs for longer than five years, while 20% of all businesses have been held for longer than 10 years. VCTs have also boosted exports and R&D in investee companies.

Investing across the UK

Investing across the UK

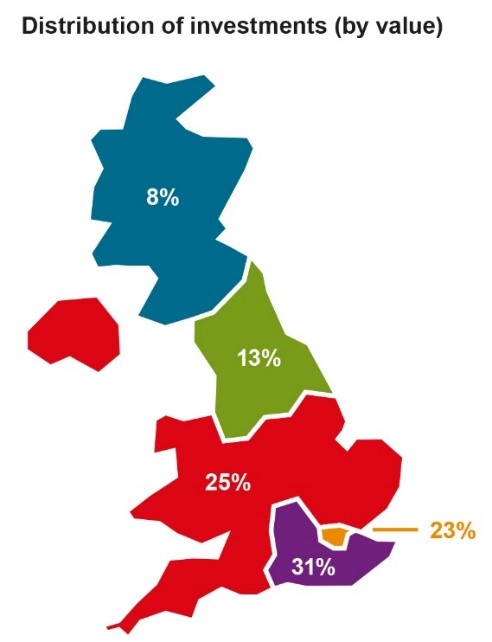

HM Treasury wants patient capital to be available to businesses across the UK. The AIC’s review found that 46% of VCT investment has been made to businesses located outside London and the South East.

2015 rule changes intensify focus on ‘growth’ investments

Since rule changes in November 2015 that focus VCT investment more closely on young companies, over 100 investments with a value of £213 million have been made. For example, Livingbridge VCTs invested in online fashion retailer In The Style in May 2017 to help the business grow its management team and warehouse operations, and enter markets in America and Australia.

In addition, Calculus VCTs invested in Weedingtech, which designs and manufactures herbicide-free weed control systems, in December 2016. Weedingtech’s core product kills weeds and moss using close to boiling water encapsulated in environmentally friendly organic foam. It responds to environmental and health concerns raised by certain chemicals. Calculus VCTs invested to boost Weedingtech’s sales, manufacturing and product development capabilities.

Achieving growth is the fundamental ambition of VCTs and in the current VCT portfolio, every £1 million of investment has been accompanied by an average increase of £2.2 million in turnover. Over a longer period this growth has been greater, with businesses receiving investment more than five years ago achieving average turnover growth of £3.9 million per £1 million invested. Those who received funds over 10 years ago performed even more strongly, with an average turnover of £8 million per £1 million invested.

Follow-on finance

VCTs invest for the long term and providing follow-on finance is a key aspect of this approach. Many investee companies have been able to rely on continued financial support to move them to the next stage of their commercial development. The AIC’s review found that 60% of companies* received more than one investment, whilst almost half (44%) received more than two investments.

Ian Sayers, Chief Executive of the Association of Investment Companies said: “VCTs have provided vital scale up capital for the UK’s smaller companies, the engine of the UK economy. Entrepreneurs also have benefited from the support of expert fund managers seeking out the commercial potential of new technology and entrepreneurs with the skills and ambition to make a difference.

“VCT investment boosts smaller companies across the UK. It targets younger companies with a majority of businesses receiving funds being less than a year old. The AIC’s review demonstrates VCTs are an essential way in which small businesses secure access to long-term finance.”

-Ends-

Follow us on Twitter @AICPRESS

Notes

- *The number of companies excluded those that have been held for less than three years

- Launched in 1995, the VCT scheme provides investors with 30% upfront tax relief upon the purchase of new VCT shares with a minimum holding period of five years.

- The Association of Investment Companies (AIC) was founded in 1932 to represent the interests of the investment trust industry – the oldest form of collective investment. Today, the AIC represents a broad range of closed-ended investment companies, incorporating investment trusts and other closed-ended investment companies and VCTs. The AIC’s members believe that the industry is best served if it is united and speaks with one voice. The AIC’s mission statement is to help members add value for shareholders over the longer term. The AIC has 352 members and the industry has total assets of approximately £173.7 billion.

- Disclaimer: The information contained in this press release does not constitute investment advice or personal recommendation and it is not an invitation or inducement to engage in investment activity. You should seek independent financial and, if appropriate, legal advice as to the suitability of any investment decision. Past performance is not a guide to future performance. The value of investment company shares, and the income from them, can fall as well as rise. You may not get back the full amount invested and, in some cases, nothing at all.