Nick Britton blog: Platform change?

Why it’s important to review whether you’re getting value for money from your investment platform.

Changing your investment platform is like changing your bank: a process you’d probably prefer not to contemplate. I have done it three times in my life, so I know it can be a bit painful, and there are often associated costs that have to be considered, but in each case, it’s been worth it.

Changing your investment platform is like changing your bank: a process you’d probably prefer not to contemplate. I have done it three times in my life, so I know it can be a bit painful, and there are often associated costs that have to be considered, but in each case, it’s been worth it.

That’s because my needs have changed over time. What was a good platform for building up savings when I was starting out, didn’t have all the investments I wanted a few years later. A few switches later, I’m with a platform that offers all the investments I need with decent service and charges that I feel represent good value.

My experience of the hassle of switching platforms was, in part, what inspired a piece of research that the AIC has commissioned on the relative costs of holding investment companies (and funds) on different platforms. This research, conducted by number crunchers at an Edinburgh-based company called the lang cat, was intended to help people selecting a platform to make the right choice first time, but it can also be used by those who have a platform already, to see if they could pay less elsewhere. It covers all the main ‘direct to consumer’ platforms such as Hargreaves Lansdown, Alliance Trust Savings, AJ Bell and Interactive Investor.

Let me be clear (as politicians love to say these days), I’m not suggesting you switch platforms at the drop of a hat, just because you’ve found a slightly cheaper deal elsewhere. Cost is not everything – service and trust in the provider are crucial too. But costs are very important.

To illustrate this, imagine you are paying your platform 0.2% of your assets a year to hold your investments. That’s £100 a year on a portfolio worth £50,000. Now imagine that you are paying 0.4%, or £200. That difference, compounded over time, adds up to a lot. Over ten years, you’re £1,647 worse off with the more expensive platform; over 20 years, £5,734 worse off. You might decide that you are happy to pay a few thousand pounds over two decades for what you consider to be a superior service, or you might not. But that should be a choice you make once you’re in possession of the facts.

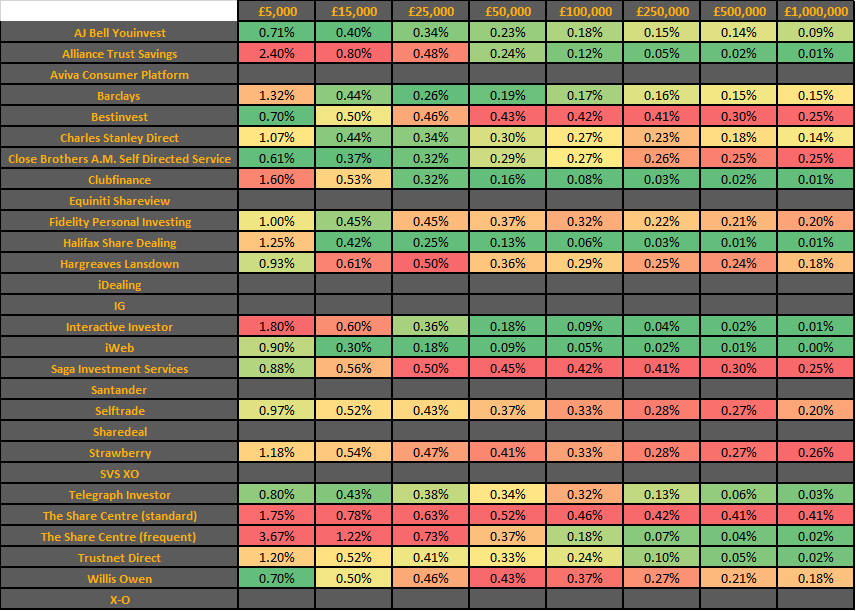

Sadly, comparing platform costs is not easy, because they depend on exactly how much you have invested and how often you trade (buy and sell investments). To help, our research with the lang cat compares costs at eight different levels, from £5,000 to £1 million. We have assumed you have an ISA on each platform and trade four times a year, which is not a lot, but realistic for a ‘buy and hold’ type investor. The table below looks at the platform costs for holding a portfolio which is invested 50% in funds (such as OEICs and unit trusts) and 50% in investment companies.

The values in the table show the percentage of your assets on the platform that is eaten up by platform charges, both custody charges (usually dependent on the value of your assets on the platform, though this can be a flat fee) and trading costs. A wide variation in costs is notable: for a £25,000 portfolio, for example, you could be paying anywhere between 0.18% (£45) and 0.73% (£184), a near-fourfold difference. Platforms that do not have figures next to them do not offer both funds and investment companies, only one or the other.

The full research, should you wish to view it, is available on the AIC website, together with a complete list of assumptions made in coming up with the figures.

Don’t rush to change your platform – everyone’s circumstances are a bit different and the scenarios are for general guidance only. Also, please remember that many platforms have exit fees which can be £15 to £25 per holding. To reduce these, you can encash all your holdings before making the switch, but then you’ll be out of the market for as long as it takes.

Switching is still a messy business and platforms don’t always make it easy. But there may be circumstances where it can be worth the hassle. If in doubt, we suggest you consult a financial adviser.

Nick Britton is Head of Training at the AIC.