Which platform is the best choice for investment companies?

New AIC research identifies the best platforms to use for investment companies, whether you’re a £50-a-month kind of investor or have a large portfolio.

This article was updated on 09/01/18.

So, you want to buy investment companies on a platform. Which one’s right for you? Even just understanding the menu of charges can be bewildering, let alone calculating which is going to cost you less in the long run.

It’s not all about costs, of course. You need to trust your platform to treat you properly and provide excellent service. But costs are important. We thought it would be helpful if we could give an idea of how much you’ll pay to hold investment companies on platforms, which depends largely on how much you hold and how you trade.

The research has been conducted by Edinburgh-based consultancy firm the lang cat. The platforms covered are listed below, along with the different tax wrappers (ISA, pension, etc) that are available.

| D2C platform | Investment account | Pension | ISA | Junior ISA | Flexible ISA | Lifetime ISA | Fund investment | Investment companies |

|---|---|---|---|---|---|---|---|---|

| AJ Bell Youinvest | ✔ | ✔ | ✔ | ✔ | ✘ | ✔ | ✔ | ✔ |

| Alliance Trust Savings | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ | ✔ |

| Aviva Consumer Platform | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ | ✔ | |

| Barclays | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ | ✔ | ✔ |

| Bestinvest | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ | ✔ |

| Charles Stanley Direct | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ | ✔ | ✔ |

| Close Brothers A.M. Self Directed Service | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ | ✔ | ✔ |

| Clubfinance | ✔ | ✘ | ✔ | ✘ | ✘ | ✘ | ✔ | ✔ |

| EQ Shareview | ✔ | ✘ | ✔ | ✘ | ✘ | ✘ | ✔ | |

| Fidelity Personal Investing | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ | ✔ |

| Halifax Share Dealing | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ | ✔ |

| Hargreaves Lansdown | ✔ | ✔ | ✔ | ✔ | ✘ | ✔ | ✔ | ✔ |

| iDealing | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ | ✔ | |

| Interactive Investor | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ | ✔ |

| iWeb | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ | ✔ | ✔ |

| Saga Investment Services | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ | ✔ | ✔ |

| Santander | ✔ | ✘ | ✔ | ✔ | ✘ | ✘ | ✔ | |

| Selftrade | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ | ✔ | ✔ |

| shareDeal active | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ | |

| Strawberry | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ | ✔ | ✔ |

| SVS XO | ✔ | Coming soon | ✔ | ✘ | ✘ | ✘ | ✔ | |

| Telegraph Investor | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ | ✔ |

| The Share Centre | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Trustnet Direct | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ | ✔ |

| Willis Owen | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ | ✔ |

| X-O | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ |

So, how do the platforms compare when it comes to cost? The main costs for holding investment companies on a platform are:

- Ongoing costs, also known as admin costs, or custody costs. These are usually based on a percentage of the assets held, often between 0.25% and 0.45%, though charges may fall or be capped when you go above a certain level of assets. They are not affected by how much you trade.

- The transaction costs you pay when you buy or sell shares in investment companies. This is usually a set amount per trade, somewhere between £5 and £12.50. The more you trade, the more you’ll pay (though some platforms offer lower rates for frequent traders).

There’s a couple of other things to bear in mind. Some platforms allow you to reinvest dividends for a fairly low charge, while others don’t: with these, you’ll have to pay the standard transaction costs. Some platforms offer particularly low charges for regular monthly investing, which can really help bring costs down (though it may only be available for larger investment companies, for example, those in the FTSE 350). You’ll tend to pay more for a pension than for an ISA or general investment account.

The table below sums up the different charges at the various platforms

| Core charges | Pension | Ad hoc investment company transactions | Regular investing charge | Automatic dividend reinvestment fee | |||

|---|---|---|---|---|---|---|---|

| AJ Bell Youinvest | 0.25% platform charge for non-fund investment (capped at £30 for GIA/ISA and £100 for pension). | No additional charge | £9.95 a deal, reducing to £4.95 if there were 10 or more deals in the previous month. | £1.50 | 1% (min £1.50, max £9.95) | ||

| Alliance Trust Savings | £10 a month = £120 pa (comes with 4 free trades bundled in). Applies to each wrapper if you have both an ISA and a dealing account. | £17.50 + VAT a month = £252 pa (comes with 4 free trades bundled in) |

£9.99 per transaction (Noting that you get 4 free transactions bundled in with each wrapper) |

£1.50 | £5 | ||

| Aviva Consumer Platform | |||||||

| Barclays |

0.10% platform charge. Minimum of £48 pa and maximum of £1,500 pa. Collected monthly. |

£150 annual fee applies. | £6 | £1.00 | 1% (min £1, max £7.50) | ||

| Bestinvest |

Value Up to £250k |

Charge (pa) 0.40%* |

*Pension investment is charged at 0.30% for the first £250k rather than 0.40%. | £7.50 | No discount | N/A | |

| Charles Stanley Direct | There is a charge of 0.25% for Investment Company investment with a minimum of £24 and maximum of £240 per year. This is waived if you trade in the month. | £120 annual fee applies, which is waived if you hold a total portfolio (across all investment and wrapper types) of £30,000 or more. | £11.50 | No discount | N/A | ||

| Close Brothers A.M. Self Directed Service | 0.25% pa | No additional charge | £8.95 | No discount | N/A | ||

| Clubfinance | No fee providing you trade 3 times in a quarter. Otherwise, £15 per quarter. | £4.95 | No discount | N/A | |||

| EQ Shareview |

0.50% pa with a £24 minimum and £90 maximum for ISA. No annual charge for dealing account. |

£12.50 | £1.75 | £1.75 on selected equities | |||

| Fidelity Personal Investing | For ISA: | No additional charge |

0.10% dealing charge. The service fee for ETFs and Investment Trusts is capped at £45. Dealing accounts are not subject to this fee. |

No discount | N/A | ||

|

Value Up to £7,500 |

Charge (pa) £45 |

||||||

| Investment Trusts held within a dealing account are not subject to this fee | |||||||

| Halifax Share Dealing |

£12.50 per year charge for ISA. No annual charge for dealing account. |

Value Up to £50k |

Charge (pa) £90 |

£12.50 | £2.00 | 2% (max £12.50) | |

| Hargreaves Lansdown | 0.45% pa for Investment Companies (capped at £45 for ISA and £200 for SIPP with no charge for GIA.) | No additional charge | £11.95 a trade reducing to £8.95 if there were 10-19 trades in the previous month, reducing further to £5.95 if there were more than 20 trades. | £1.50 | 1% (min £1, max £10) | ||

| iDealing | £20 per annum admin fee per account. | £20 per annum admin fee. | £9.90 | No discount | N/A | ||

| IG | £0 | £195 annual fee | £8 per trade reducing to £5 if 10+ trades were placed in the previous month. | No discount | N/A | ||

| Interactive Investor | Quarterly £22.50 account fee (offset as credit for future trades). | £120 annual fee |

£10 per trade. If you've traded 10 times or more a month on average in the previous quarter then you'll qualify for a frequent trader rate of £6 for the next month. |

£1.00 | 1% (max £10) | ||

| iWeb | £25 one-off account opening fee for ISA and dealing account. |

Value Up to £50k |

Charge (pa) £90 |

£5 | No discount | 2% (max £5) | |

| Saga Investment Services |

Value Up to £250k |

Charge (pa) 0.40%* |

*Pension investment is charged at 0.30% for the first £250k rather than 0.40%. | £11.95 | No discount | N/A | |

| Santander | |||||||

| Selftrade | £0 | £118.80 pa fee applies. | £11.75 (£9.99 for ETFs) reducing to £6 if 20 trades are placed in a month (across all accounts). | £1.50 | £1.50 | ||

| shareDeal active | £0 | £118.80 pa fee applies - although this will be refunded if there is an active share dealing account linked to the pension | £9.50 | No discount | N/A | ||

| Strawberry |

Value Up to £50k |

Charge (pa) 0.35% |

£120 pa fee applies. | £9.50 | No discount | N/A | |

| Minimum charge of £30 pa. There is also an annual platform charge of £10. | |||||||

| SVS XO | £0 | £7.95 | No discount | N/A | |||

| Telegraph Investor | 0.30% with a minimum of £20 and maximum of £300 per year. | £96 pa. However, the £300 cap is still in force i.e. the SIPP fee effectively reduces the platform cap to £204. | £10 | No discount | 1% (max £10) | ||

| The Share Centre |

£57.60 charge for ISA (£4 + VAT per month). £21.60 charge for GIA (£1.50 + VAT per month). |

£172.80 pa (£12 + VAT per month) |

Standard option - £7.50 for deals under £750, 1% above. Frequent dealing option - a flat rate of £7.50 a trade plus £96 pa admin fee. |

0.5% (min £1.00) | 0.5% | ||

| Trustnet Direct | 0.25% pa with minimum of £20 and maximum of £200. | £96 pa fee | £10 per buy/sell reducing to £6 for the rest of the month if you've paid for 10 full price trades that month. | £2.00 | £1 (max £10) | ||

| Willis Owen |

Value Up to £50k |

Charge (pa) 0.40% |

£132 pa fee | £7.50 | £1.50 | £1.50 per reinvestment up to a maximum of £15 per year | |

| X-O | £0 | £118.80 pa fee applies although this will be refunded in full providing you invest your SIPP in the X-O dealing account. | £5.95 | No discount | N/A | ||

Be aware that if you hold open-ended funds (OEICs or unit trusts) as well as investment companies, charges will be different.

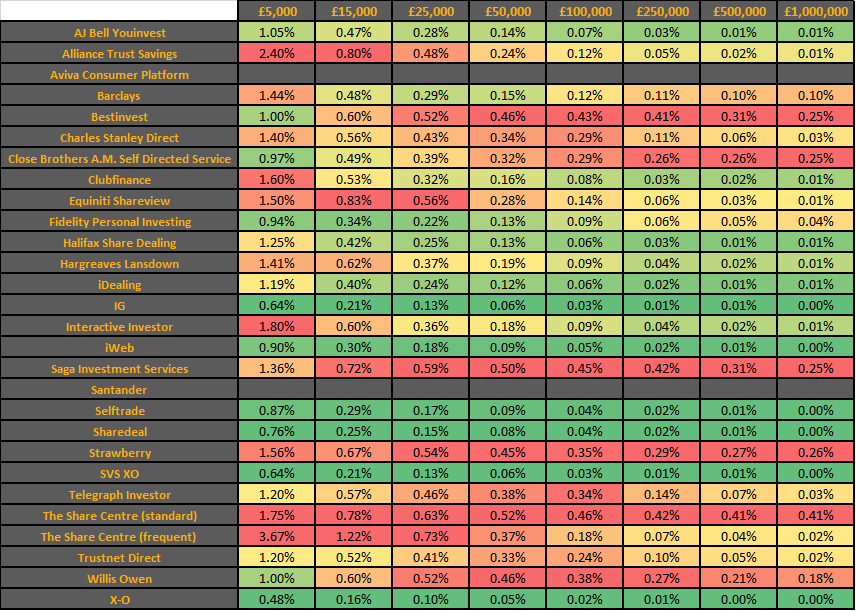

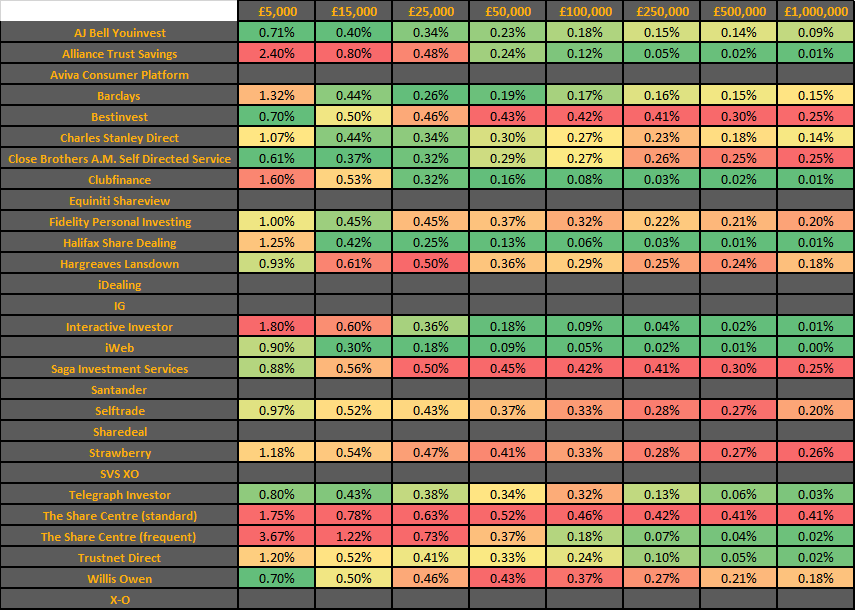

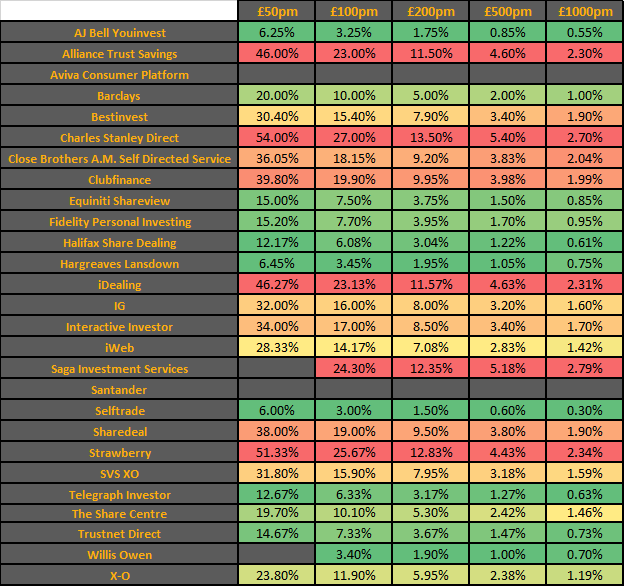

While we hope the above information is useful, we appreciate it’s still quite difficult to see which platforms might be cheaper or more expensive. So the lang cat has produced some handy ‘heatmaps’. As you’d expect, red is expensive, green is cheap and orange is somewhere in between. This makes it easy to see at a glance how much you might pay. The assumptions used by the lang cat in producing these heat maps are detailed in the footnotes to this article.

First, let’s look at how expensive each platform would be if you invested only in investment companies. The table shows the annual costs, as a percentage of your portfolio, at different sizes of portfolio, from £5,000 invested up to £1 million. It’s assumed that you are a buy-and-hold investor and make only four trades (buys or sells) a year (1).

You’ll see that charges vary quite a lot. Let’s say you have £50,000 invested. That could cost you as little as 0.05% a year with X-O (£24) or as much as 0.52% with The Share Centre if you choose their standard charging option (£258). That’s a tenfold difference!

To be fair to The Share Centre, if you go with their inclusive charging option you’ll pay significantly less (0.37%, or £184). And let’s say it again, loud and clear: it’s not all about price but service and reliability too.

If you hold open-ended funds in your portfolio as well as investment companies, things look a bit different. You can’t use X-O, which is equities-only. The cheapest option is now iWeb, which will charge you 0.09% on a £50,000 portfolio (£45). Below, you can see annual charges for 50/50% portfolios of funds and investment companies (2). You’ll notice some platforms have no figures next to them: these are platforms that do not offer both investment companies and funds, just one or the other.

Finally, let’s look at the charges for regular monthly investing. The following heatmap shows how much you would pay if you started with zero invested on a platform and chose just one investment company as a regular monthly investment (3). You’ll notice that some of the fees look extremely high, especially for platforms that do not offer lower fees for regular investing (like Charles Stanley Direct), and/or have flat admin charges (like Alliance Trust Savings). These platforms may be more cost-effective at higher levels of investment, or if you already have a portfolio of investments to start with.

Want to invest less than £50 a month? Some platforms allow you to make regular investments of as little as £25, but if you want to go down this route, make sure there are reduced dealing fees for regular payments.

We hope this information is useful to you in choosing a platform. If you have any questions, please do get in touch!

Notes

- This table looks at the cost of investing on each platform for one year. Calculations include ongoing platform fees, any additional wrapper charges and trading where applicable. It’s assumed that you invest in an ISA, with 100% of your holdings in investment companies making four transactions (buys or sells) in the year. Data is based on publicly available charging structure information with some details verified via conversations with platforms. Data updated 05/01/18.

- The notes above apply, except that the portfolio is split 50/50% between investment companies and open-ended funds (OEICs and unit trusts) and it’s assumed that you make four transactions (buys or sells) a year, of which two are investment company transactions and two are open-ended fund transactions. Data is based on publicly available charging structure information with some details verified via conversations with platforms. Data updated 05/01/18.

- This table looks at the cost of investing on each platform for one year. Calculations include ongoing platform fees, any additional wrapper charges and trading where applicable. It’s assumed that you invest in an ISA, making a monthly single investment company purchase. Note that some platforms impose a minimum monthly subscription and have thus been excluded from some monthly payment levels. Data is based on publicly available charging structure information with some details verified via conversations with platforms. Data updated 05/01/18.