Outlook for Europe

Sam Morse, Manager of Fidelity European Values, on the outlook for Europe as Brexit begins.

2016 will be remembered as a year of political “shocks” with three outcomes which, at the beginning of the year, might have been considered market risks: a yes to Brexit, Trump’s election and Renzi’s resignation following the rejection of his proposals for constitutional reform. Despite all this, continental European stock markets made modest progress in Euro terms in 2016 (while delivering strong gains in sterling terms) and have continued to rally in the first quarter of 2017.

2016 will be remembered as a year of political “shocks” with three outcomes which, at the beginning of the year, might have been considered market risks: a yes to Brexit, Trump’s election and Renzi’s resignation following the rejection of his proposals for constitutional reform. Despite all this, continental European stock markets made modest progress in Euro terms in 2016 (while delivering strong gains in sterling terms) and have continued to rally in the first quarter of 2017.

European markets today: Reasons to be cheerful

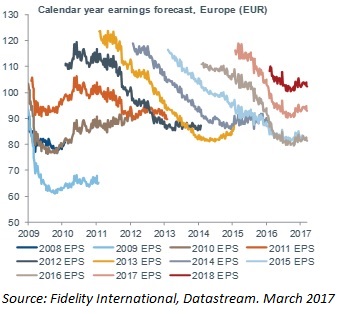

Most importantly, the outlook for company earnings has improved as confidence in global growth has risen. After a number of years during which European companies have delivered little in the way of earnings and dividend growth, analysts are now forecasting double digit earnings growth for 2017 and 2018. Earnings revisions ratios turned positive last summer and have not been this positive in 5 years.

Earnings are now being revised up!

The question is: how much of this good news is already priced in by the market, following its strong performance? Absolute valuations in continental Europe are high by historical standards. If, however, current multiples hold, perhaps partly thanks to continued ECB support, then investors can look forward to satisfactory returns driven by the combination of dividend yield and dividend growth.

The question is: how much of this good news is already priced in by the market, following its strong performance? Absolute valuations in continental Europe are high by historical standards. If, however, current multiples hold, perhaps partly thanks to continued ECB support, then investors can look forward to satisfactory returns driven by the combination of dividend yield and dividend growth.

Reasons to be cautious

A high level of valuation leaves the market vulnerable to exogenous shocks. Continental Europe sees a busy political calendar in 2017 with French, German and, possibly, Italian elections to look forward to, not to mention the on-going Brexit negotiations. The main risk, however, would be any hiatus in confidence in the current economic improvement which is buoyed by optimism that Trump’s promises of tax cuts and infrastructure spending will come good and will boost the US economy. There is a risk, of course, that if his programme fails to deliver against what appear to be fairly high expectations, investors could lose enthusiasm and turn more cautious.

There are some warnings signs that sentiment is extended. One example might be the flurry of new issues, some at high, and, possibly, quite speculative valuations, given immature business models. As always, markets can get ahead of themselves and as Warren Buffett famously advised: “Be fearful when others are greedy”.

Stock picking opportunities

Against a backdrop of relatively high valuations, by historical standards, and increased market optimism, especially in the more cyclical sectors, selectivity remains important. Personally, I remain focused on attractively valued companies with good steady long-term dividend growth prospects, through economic cycles, which also enjoy strong balance sheets and good cash generation. These sorts of companies may, in buoyant times, appear less exciting to investors than more leveraged companies that are sensitive to the economy but they will prove more robust when some of the excitement evaporates. These sorts of companies have suffered a relative de-rating in recent months as investors have focussed on the recovering fortunes of riskier companies. A rising tide lifts all boats and valuations now appear more balanced across the market. Companies such as Fresenius Medical Care or Nestle, for example, now appear to be more attractive on a relative basis given the sustainability of growth in the longer term.