The price at which you can buy shares for when two prices are quoted. This is also shown as the ‘buy’ price and will be the higher of the two prices shown.

See share price.

Here you’ll find definitions of terms used on the AIC site. Enter the term you want to search for in the box, or click on the letter it begins with.

The price at which you can buy shares for when two prices are quoted. This is also shown as the ‘buy’ price and will be the higher of the two prices shown.

See share price.

A measure, expressed as a percentage of NAV, of the regular, recurring costs of running an investment company.

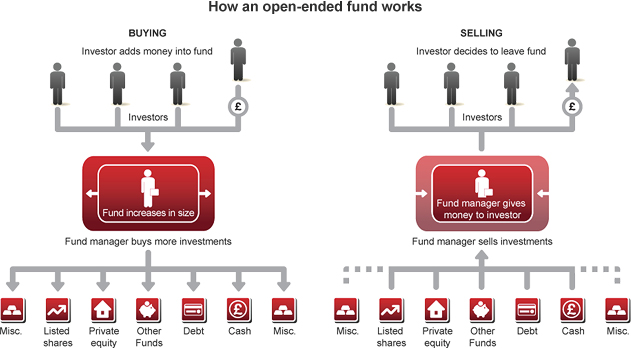

A collective investment fund which increases and decreases in size as investors enter and leave it.

Open-ended funds are constantly expanding and contracting as investors move their money in and out. This means fund managers have to manage the fund to be able to meet the demands of investors who may want their money back at any time. Because of this, open-ended funds are often restricted to investing in liquid assets.

An open-ended fund in the form of a company.

See unit trust.

In a conventional investment company, this is the only class of share issued and benefits from all the income and capital growth in the portfolio.

Developed by Moore-Wilson